Everything You Need to Consider Before Buying Your First Home

Maybe you’ve been living in a nice apartment for a decade, or maybe you’re just a few years out from college or a vocational program. Either way, you’re probably feeling the need for a real home. So how do you make it happen?

On the surface, the idea of buying a home seems pretty straightforward, but there are many important details to work out before you’re ready. These 30 tips and questions will help you get there in one piece.

Understand Why You Want to Buy a House

The very first thing to do before taking this giant leap is figuring out why it is you want to buy a home. Doing so will let you determine if you have the resources to realistically acquire a house you’d be happy with and understand what you need to look for moving forward.

Write out your reasons so you can visualize all your motives at once. Remember, while you can always change apartments if you need more space or a better school district, a house is long-term commitment. Your reasons for wanting a house need to be ones that will stay constant over the coming years.

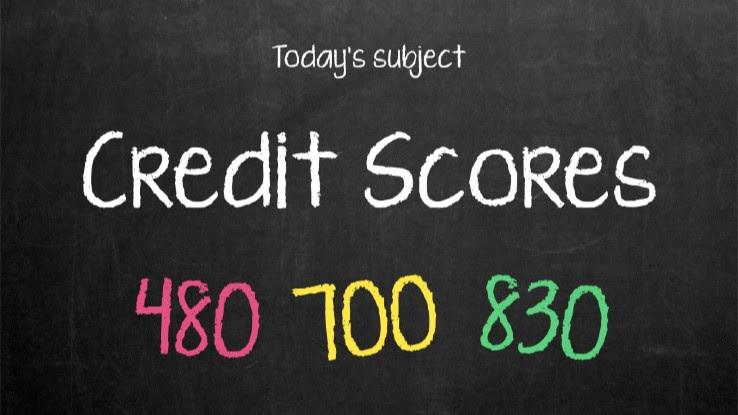

Know Your Credit Score

Your credit score is plays a huge role in your ability to buy a home. A good score will help you save money through low-interest loan rates and make you more appealing as a potential homeowner and borrower overall.

If your score is lower than 700, you’ve got some work ahead of you. You may need to postpone the search for a while until you’ve got a better score, else you might wind up with a mortgage that costs more than you can afford in the end.

Save Up for Your Down Payment

While much of your mortgage will likely be paid off in the future, you still need to save up a sizable amount for a downpayment on your first home. On the upside, the more you lay down yourself, the less you need to borrow from a bank.

You need to put down at least 20 percent of the total price of the house to avoid a private mortgage insurance policy (PMI), which significantly increases your monthly payments. By paying more up front, you save loads in the long run.

Learn the Meaning Behind Those Fancy Real Estate Terms

There are tons of terms you’ll hear tossed around while you’re in the process of purchasing a house, and it’s important that you understand what they mean. While a good agent or trustworthy bank will often explain such terms if you ask, it’s best if you understand them before looking for a house — after all, not all agents and banks are looking out for your interests.

Words and phrases you’ll hear and need to understand include the assessed value, bad title, home warranty, fixed-rate, and adjustable-rate mortgage.”Study them to know what it is you’re agreeing to with your loan officer, realtor and the seller of your new house.

Get Pre-Approval for Your Home Loan Before You Start Shopping

Another financially important thing to do before looking for houses is to get your loan pre-approved. Pre-approval not only lets you know how much you can borrow from the bank, but it also lets sellers know that you can follow through on any offer you make.

If you’re pre-approved for more money than you actually want to spend, sellers may take that as a signal to raise their asking price or refuse to negotiate. However, many banks are willing to provide you with a letter of approval that’s actually lower than the real amount. It’s a useful trick.

Use a Trusted Realtor

As you begin your journey to a new home, it’s critical that you find a realtor that you trust. The best and easiest way to do that is to ask around among coworkers, family and friends that live in the approximate area to which you plan to move.

If you don’t know anyone who’s recently worked with an agent, you can review brokerages and agencies on sites like Yelp and Google. Just be sure to read the reviews thoroughly to determine that they haven’t paid for positive reviews or are the victim of multiple negative reviews from one or two disgruntled people.

Remember That Buying a House Involves a Contract

Buying a house is all about contracts: ones with your bank, the seller of the house, and more. You’re signing important legal documents that will affect your life for years to come, so make sure you read the fine print.

Keep in mind that just like a job contract, some of these agreements can be negotiated. This is particularly true of your deal with the seller — don’t be afraid to come in below their asking price if your realtor think it isn’t worth it or ask for concessions.

Clearly Communicate Your Vision to Your Agent

For your real estate agent to truly help you find what you’re really looking for, it’s important to not only have established your own goals for a house, but also to clearly communicate them to your realtor. If there’s a particular type of home you love or despise, let that be known right off the bat.

Don’t waste time looking at ranches if you hate single-story homes. Instead, communicate your must-haves and dreamy ideals. You never know what houses your realtor may be aware of, and their entire job is finding a house that works for you.

Buy the Home You Need in The Near Future, Not Just Today

From kids to new jobs to lifestyle changes, odds are your needs and desires aren’t going to stay the same over the coming decade. And since you’re buying a house, not renting you want to make sure that you’re buying a home that will allow you to grow and change.

If you’re engaged or pregnant, your home will need to be larger than it was when you were living as a family of one or two. If you’re planning to get a dog or a cat, you’ll need more space than you probably have now. As you shop, think of your five- and 10-year plans.

Have an Exit Plan if You’re Buying With a Non-Marital Partner

People have plenty of reasons for buying a house with someone they’re not married to, whether it’s objection to the institution, finances or something else. However, many laws concerning homeownership aren’t designed around people that aren’t married. This is particularly important when one owner of the house decides to leave the other.

You should have an agreement in place with respect to titling, mortgage payments, liability, repairs and more before you buy. However, because real estate laws on the subject vary from state to state, this is one situation where consulting a lawyer beforehand could be wise.

Look Past the Paint Color

While looking for houses, it’s common to find that they’ve been decorated in weird ways — or at least, in ways you certainly wouldn’t have done. If all you have to judge a house on is sickly yellow walls, it can be tempting to rule it out.

However, painting is perhaps the cheapest way to renovate a house, so deciding not to buy a place for $60,000 just because it requires a few hundred or even a thousand dollars in paint to suit your tastes makes no sense.

Plan Ahead for Your Furniture

If you have furniture that you want to bring into your new home, you probably already have some idea of where each piece will go. However, if you’re planning to upgrade your furniture, you’ll want to start taking notes as you shop houses.

Beyond choosing your new furniture and deciding where it will go in an unfamiliar environment, you also need to decide if you’ll be buying it all at once when you’re already putting a downpayment on a house or if you’ll space things out.

Don’t Do Anything to Change Your Financial Situation

Your pre-approval is founded on the information you provided when you made your application. That means any changes to your finances afterward could affect your entire situation. It might even cost you the house of your dreams.

Because of that, when you’re in the process of buying a house, you shouldn’t upgrade your car, change jobs, get married (unless you applied together) or change anything else financially significant. Doing so could potentially lower the mortgage you’re offered when it comes time to make an offer.

Consider the Housing Market in Your Timing

One of the things that may help you decide when to buy a home is the housing market itself. If you purchase a home at the wrong time, you might regret it for many decades to come, depending on the loan you get.

While some areas experience steady growth or declines in housing prices over time, they’re usually still susceptible to short-term booms and busts as well, so watching prices over time could help you gain an advantage. Interest rates on mortgages also fluctuate and can mean you end up paying significantly more or less over time.

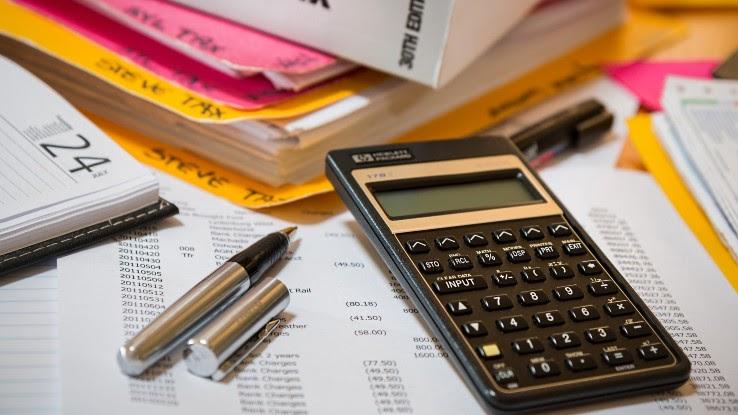

Don’t Forget Past Debt as You Plan and Budget

Budgeting for the many expenses of homeownership — property taxes, extra utility bills, homeowners insurance and more — is certainly important. However, you also need to factor in existing expenses as well, especially past debt.

Not only can your debt add to your monthly expenses, but it can also decrease how much money banks are willing to loan you. College debt is particularly troublesome when it comes to buying a house, since it’s often large enough to have a noticeable impact on how much you can borrow.

Don’t Fixate on the Price of the House

A lot of young buyers fixate on the specific price of the house they’re interested in. They get it in their heads that as long as they can afford it with their cost of living and the sticker price accounted for, they should be good to go.

In reality, the purchase price is only a small part of what determines if you can afford a house or not. A house in poor repair may end up costing far more than expected, while a well-insulated one may actually have lower heating bills than expected. The house’s cost is certainly important, but it’s not the only factor to keep in mind.

Shop Around for the Right Mortgage

You’ve been pre-approved for your mortgage, which is great. However, that’s not where this loan journey ends. You need to shop around a bit to find the exact fit for your needs and your finances, as not all mortgages are created equally.

Check out at least three lenders or mortgage brokers to increase your chances of getting the best rate possible. Check the reputations of the brokers and lenders online and always ask what first-time buyers’ programs or incentives are available to you.

Don’t Buy a House You Cannot Afford

This may seem like common sense. but never buy a house you cannot afford. Unlike other situations where you spend too much money, buying a house that’s too expensive hurts you not just in the present, but well into the future, as mortgage payments leave you poor for a long time.

A formula that some lenders suggest is paying no more than a third of your gross income. Other lenders suggest a much more conservative stance of spending no more than 28 percent for all your housing-related costs, including taxes, insurance and mortgage payments.

Know Every Single Expense Involved

One of the downsides to buying versus renting is the sheer amount of paperwork and number of expenses you need to handle. There are numerous fees and taxes that you should be prepared to include in your budget so as not to be surprised.

When you are looking at possible houses, make sure that your agent is willing to give you the big picture of how much the purchase will really cost you. It would be unfortunate to find your perfect house and then discover another few thousand dollars in fees, knocking it out of your price range.

Don’t Worry About the Ugly Carpet

Like paint, if a home has everything you’re looking for except an ugly carpet that’s tacky, uncomfortable or just plain gross, you can probably change it without too much hassle. You can either pay someone to change the carpet or find some decently priced squares and replace it yourself.

Better yet, you might even peel it up and discover some beautiful hardwood floors underneath. While it’s certainly not guaranteed, it is a possibility. There’s nothing like original hardwood floors in an old home to add class to a place.

Always Get a House Inspection Before Buying

It is important to have a house inspection before you purchase a property. If you’re getting a loan, the lender may even require you to get an inspection as part of your contract. A home inspection can help you better understand any structural or mechanical issues that are present.

Your real estate agent may suggest an inspector, but it’s important to do your own research before agreeing to hire one. Fees may vary, but on average, you can expect to pay anywhere from $300 to $450 for an inspection, with larger houses having higher prices.

Don’t Get Pressured Into Anything

It’s important not to allow yourself to be pressured into any sale. Not every agent has your best interests at heart, and some are not above trying to cause panic and anxiety to make a sale and earn their commission. Until you sign the paperwork, you are under no obligation to purchase a house, no matter how many properties you have been shown.

If you are feeling pressured to make a purchase you are not comfortable with, walk away. If your agent is part of an agency, you may want to consider filing a complaint with their supervisor.

Consider Flooding Potential

Once you’ve found a house you like, determine whether or not it lies in a floodplain. The closer the house is to water, the greater the chance there may be flooding during storms. Even if the house isn’t near water, the property itself may be prone to collecting it, especially in the basement.

Houses in a floodplain require special insurance, which means they’re pricier on a monthly basis as well as in the event of a disaster. Other dangers to be aware of include tornadoes and especially seasonal fires.

Decide If Buying a Fixer-Upper Will Save You Money or Not

For some of us, the idea of a fixer-upper is a total thrill. You can buy a house that’s basically a shell and build it up from the floor, making it precisely what you want in practically every way — assuming the house has good bones.

While a fixer-upper can save money in the long run, it will cost more in time, and there’s always the possibility that it needs more work than you anticipated. To be safe, you should have a significant savings reserve to deal with any unexpected expenses.

Investigate Neighborhoods

As they say, location, location, location. A beautiful home can be found in just about any neighborhood. Because of that, choosing a neighborhood to search in may be even more important than the particular house you.

Before you make any commitments to a house, be sure to get to know the neighborhood you’re considering moving to. Do you feel safe and comfortable in the community? Are the schools the kind you’d want to send your kids — or future kids — to?

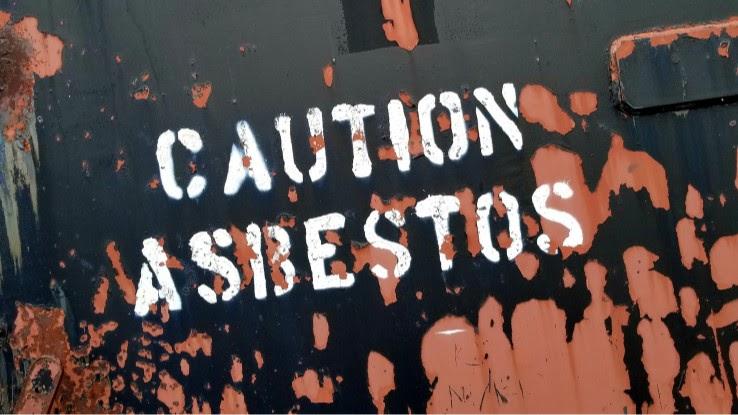

Make Sure the Inspections Involve Checking For Asbestos, Mold and Radon

When you have the property inspected, make sure there are no traces of asbestos, radon or mold. Asbestos was a frequently used building material up until 1977, and this cancerous material can cause the cost of repairs to skyrocket while destroying the resale value.

Radon is an invisible and odorless gas that can be present in both air and water, and the tests for radon are much cheaper than the cost of removal, which can easily be thousands of dollars. Additionally, mold is a health hazard that should be checked for and removed by the seller.

Don’t Settle for the First House You Like

While it can be tempting to settle for the first house whose picture you love, it’s important to see the house in person and scout out what the neighborhood is like. Make sure you have a priority list of qualities that you need in a house and the surrounding neighborhood.

Once you tour the houses and drive around each neighborhood, take extensive notes so you know what you enjoyed, how you could use particular unique aspects to meet your needs, and more. While each house seems distinct in the beginning, they blend together quickly.

Remember to Negotiate Repairs

As noted previously, you’ll probably need and want a home inspection. If it reveals a need for any repairs, speak with the agent who is brokering the deal. Depending on the repairs needed on the property, it’s possible to get the repairs thrown into your contract with the seller.

What usually happens is either the seller will agree to pay to have the repairs done or they’ll lower the price of the house accordingly. Depending on the nature and cost of the repairs, either one could be in your or the seller’s best interests, so you’ll need to negotiate to find a solution.

Understand the Homeowners Association

Before purchasing a house, you should determine if the property is governed by a homeowners association. Not all houses are part one, but some are, and they can vary wildly in their implications for you, so it’s important to know what you are getting into.

Most homeowners associations have similar requirements, such as annual dues and having to wait for the association to provide maintenance to common areas. However, the particulars of the association and the personalities of the people involved may cause problems for you down the road, so it’s important to do your homework. One of the fastest ways to find out the quality of the group is to talk to people already living in the area.

Make the Right Offer on the House You Love

An important step to getting the house of your dreams is making an offer the seller accepts. After finding the right place, your agent can help prepare the offer package. This package should include your offer, proof of funds, a copy of your pre-approval letter, terms and ideally a personal letter.

In most situations, a seller has 24 hours to make a counteroffer, and the two of you go back and forth until an agreement is made or one of you walks away. Once you decide on that, the next step is signing a purchase agreement and making a deposit on the house. It’s important to make sure any offer you sign includes contingency clauses in case unexpected issues arise.